Is Arnuity Ellipta covered by insurance? | How much does Arnuity Ellipta cost without insurance? | How to get Arnuity Ellipta without insurance

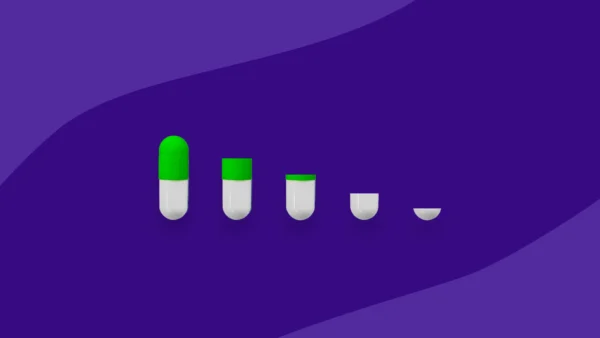

Arnuity Ellipta is a brand-name prescription inhaler used as a maintenance treatment for asthma. Its active ingredient, fluticasone furoate, is an inhaled corticosteroid that helps prevent and control the symptoms of asthma by partly blocking the immune system. A single 50 mcg or 100 mcg dose is inhaled once per day to decrease the risk and severity of asthma attacks. Arnuity Ellipta is not suitable as a rescue inhaler for asthma attacks.

As a brand-name prescription medication, Arnuity Ellipta is sold at a premium price. Unfortunately, there are no lower cost options like generic versions, over-the-counter medications, or supplements available to Arnuity Ellipta users. Instead of paying the full retail price, people prescribed Arnuity Ellipta have a variety of ways to save on that prescription.

What is the generic for Arnuity Ellipta?

There are currently no available generic versions of inhaled fluticasone furoate, the active ingredient in Arnuity Ellipta. A similar inhaled steroid, fluticasone propionate HFA, is on the market, but it costs more than Arnuity Ellipta.

Is Arnuity Ellipta covered by insurance?

Arnuity Ellipta is covered by many private health insurance plans and Medicare prescription drug plans, but coverage is not guaranteed. Talk to a representative from the insurance company before ordering Arnuity Ellipta at a pharmacy.

How much does Arnuity Ellipta cost without insurance?

Without health insurance coverage, a single breath-activated blister aerosol inhaler of Arnuity Ellipta will cost $263. This is enough medicine for 30 activations, one per day for 30 days. Which means that each daily dose costs $9. Over 12 months of treatment, this will add up to over $3,000 at the full retail price.

The dosage prescribed—50 mcg per day or 100 mcg per day—may affect the price at some pharmacies. Among inhaled steroids, Arnuity Ellipta is generally the cheapest option for cash-paying customers, including generic inhaled corticosteroids. Still, ask the prescribing healthcare professional about more affordable treatment options. These medications may work differently and have different common side effects than Arnuity Ellipta, so get medical advice before switching.

Health insurance will reduce the cost, but it’s difficult to calculate an average out-of-pocket cost. Depending on the insurance plan, Arnuity Ellipta can be grouped anywhere from a Tier 2 drug—drugs with a lower copay obligation—to a non preferred drug—drugs with a very high copay. Then there are issues such as coinsurance or, for Medicare drug plans, the current coverage phase. Even some people with insurance may need to find cost-savings strategies when purchasing a prescription.

RELATED: Arnuity Ellipta alternatives: What can I take instead of Arnuity Ellipta?

Compare Arnuity Ellipta prices to related drugs |

|||

|---|---|---|---|

| Drug name | Price without insurance of brand-name drug | SingleCare price | Savings options |

| Arnuity Ellipta | $263 for 1, 30 breath activated blister aerosol powder inhaler | $187 for 1, 30 breath activated blister aerosol powder inhaler of brand-name Arnuity Ellipta | See updated prices |

| Flovent HFA | $357 for 1, 12 gm of 110 mcg/act inhaler | $163 for 1, 12 gm of 110 mcg/act inhaler of generic Flovent Hfa | See updated prices |

| Flovent Diskus | $275 for 1, 60 aerosol powder breath activated inhaler | $169 for 1, 60 aerosol powder breath activated inhaler of brand-name Flovent Diskus | See updated prices |

| Pulmicort Flexhaler | $350 for 1, aerosol powder breath activated inhaler | $236.32 for 1, aerosol powder breath activated inhaler of brand-name Pulmicort Flexhaler | See updated prices |

| Qvar Redihaler | $362 for 1, 10.6 gm of 80 mcg/act inhaler | $230 for 1, 10.6 gm of 80 mcg/act inhaler of brand-name Qvar Redihaler | See updated prices |

Prescription drug prices often change. These are the most accurate medication prices at the time of publishing. The listed price without insurance references the price of brand-name drugs (unless otherwise specified). The listed SingleCare price references the price of generic drugs if available. Click the link under “Savings options” to see updated drug prices.

How to get Arnuity Ellipta without insurance

Arnuity Ellipta costs about $263 a month. Saving as much as possible makes sense. Unfortunately, the manufacturer, GlaxoSmithKline (GSK), does not currently offer a copay card or manufacturer coupons for Arnuity Ellipta. One way to get started is to ask your prescriber for a free sample. These samples typically cover anywhere from two to four weeks of treatment, which can buy time to research other ways to save money on an Arunity Ellipta prescription. A SingleCare discount card can help with savings. The best part is, SingleCare is easy to use.

1. Save with a SingleCare discount card

With a free coupon from SingleCare, the cash price of Arnuity Ellipta can fall to as low as $187, a savings of around 30% off the average retail price. Annual savings could exceed $900. Discounts will vary by participating pharmacy, so find the best value at convenient local pharmacies.

2. Find a pharmacy with the lowest price

Prescription drug prices can vary widely between pharmacies. Some pharmacies charge $50 less than the average retail price for Arnuity Ellipta, savings that can add up to almost $600 a year. Even better, shop for the lowest SingleCare discount price on SingleCare’s Arnuity Ellipta coupon page.

3. Consider health insurance

One of the most enduring cost-saving strategies for chronic, lifelong conditions like asthma is to get health insurance. Start with your state’s insurance marketplace. Consult with an agent to make sure that Arnuity Ellipta and other needed asthma medications are covered at a reasonable out-of-pocket cost.

4. Look into Medicaid or the Children’s Health Insurance Program (CHIP)

If private insurance is difficult to afford, consider enrolling in Medicaid or, for a dependent child, CHIP. Check your state’s Medicaid website for eligibility requirements, enrollment processes, and additional information. Before committing, however, check the plan’s formulary to make sure it covers Arnuity Ellipta.