Pharma’s post-pandemic launch performance problem: what’s the prognosis?

The prescription medicine market has recovered from the wild swings of the early pandemic with renewed growth.

COVID vaccines and treatments have created a substantial market over and above the existing Rx market- IQVIA estimates that the cumulative value of COVID vaccines could be between $185 and 295bn to 2026. However, this picture of recovery hides a less positive trend – non-COVID innovative launches from 2020 onwards, have, with certain exceptions, under-performed pre-pandemic benchmarks of launch sales performance in the major countries in the market – that is, the US, EU4+UK, China and Japan.

The scope of the problem

Non-COVID prescription medicines didn’t stop launching during the pandemic -- approvals by both the FDA and the EMA were, in fact historically high in both 2020 and 2021. Nor did companies choose to delay the launch of approved medicines, which might have been a reasonable response to the early stages of the pandemic; in fact, the non-COVID innovative medicines entered commercial channels, as measured by IQVIA, at rates above or closely similar to pre-pandemic benchmarks, with only three substantial exceptions: France, in 2020, when New Active Substance entries were 19% below the 2016 to 2019 average, and Spain in both 2020 (47% below) and 2021 (20% below).

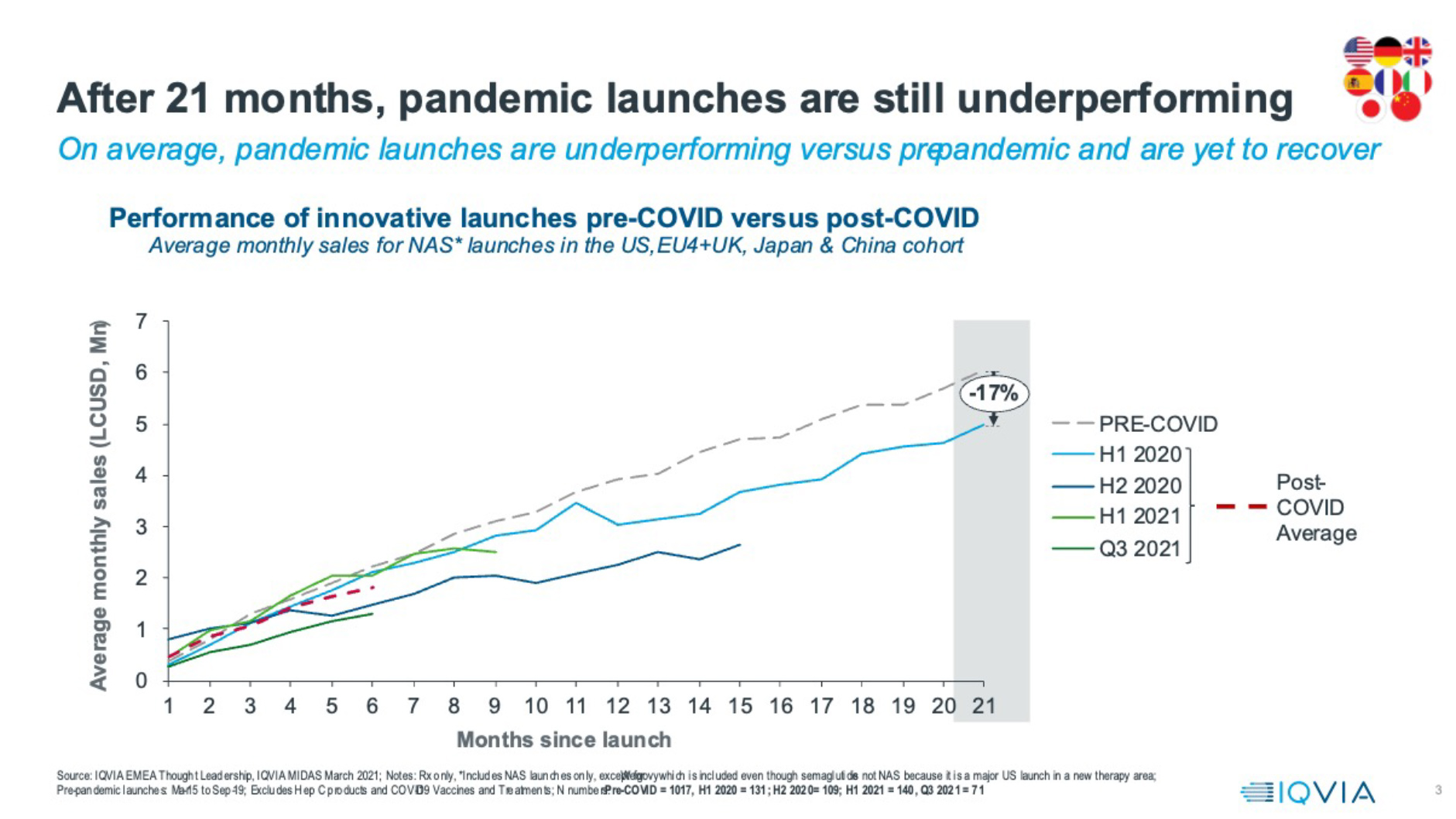

Launches, therefore, were happening. But were they fulfilling their commercial potential? On average, across the eight countries that provide over 90% of the first five years’ commercial potential for launch medicines, the answer is no. The graphic below shows month-on-month average sales across the US, China, top five Europe and Japan for all New Active Substances, divided into time cohorts. Across the post-pandemic launches, from those that entered in 2020, to those that launched in the third quarter of 2021 (and were then followed for their first six months of sales to Q1 2022) the average six-month sales remain down by 19% from the pre-pandemic benchmark.

There’s no reason to suppose that the innovative launches coming in from 2020 have suddenly become less innovative and significant in terms of commercial potential; most launches are entering the same types of therapy area – oncology, immunology and rare diseases – as before the pandemic, and the unmet need in these areas remains high. Therefore, over $1 billion of innovative launch potential could have been collectively lost to date.

Post-pandemic underperformance appears to be enduring. Breaking down the post-pandemic launches into cohorts each representing six months’ worth of launches (except the most recent, which is for one quarter) reduces the launch numbers and increases the influence of individual launches on the average, but it also allows us to understand how performance is evolving.

On average, launches of 2020’s cohorts both underperformed. The average for the first half of 2021 did seem to revive pre-pandemic levels in the first six months, but that was heavily influenced by the outstandingly positive performance of one launch: Wegovy, an obesity treatment, in the US. The most recent quarter’s worth of launches for which we have six months of sales show significant underperformance: 40% below the pre-pandemic benchmark. Furthermore, the 2020 post-pandemic launches, for which we now have up to 21 months of sales, show continued average underperformance. This performance problem is clearly persistent.

Why the pandemic hurt launches

Why are we seeing this pattern? Because there’s been a perfect storm of pandemic-initiated factors, which combined (and continue to combine) to create an environment that hurts the sales performance of launches more than inline medicines.

The initial pandemic lockdowns prevented many patients from seeing doctors face-to-face. Telemedicine rose dramatically in many countries, providing a route to managing ongoing care which was a lifeline for many patients. However, most doctors polled by IQVIA consistently state that whilst they are happy to manage many aspects of patient care remotely where possible, they want to see the patient face-to-face to prescribe a newly launched medicine.

This preference leads to fewer opportunities to prescribe new launches in an environment with fewer face-to-face opportunities, and, for many conditions, gaps and backlogs in screening, diagnosis, and check-up. Backlogs and reluctance of patients to present for diagnosis still linger, and for some disease areas a proportion of sufferers may never be diagnosed and treated, or may never be treated with the most recent launches. Launch opportunity is reduced.

Pharma, when launching, needs interaction with doctors to raise awareness, answer questions and build knowledge of and confidence in launches. Whilst it’s well-known that the channel mix of promotion tilted dramatically to remote/digital during 2020 and has remained permanently more hybrid, it’s less well known that in Europe the total amount of interactive promotional time that pharma has with doctors has not yet recovered to pre-pandemic levels in any of the major countries. Pharma simply has less interactive time with doctors. That impacts launches most.

Lastly, the growing economic crisis creates increasing challenge for medicines funding. Health systems have had to spend to address backlogs, make healthcare delivery COVID-resilient and deal with long COVID, as well as addressing COVID itself – and, as previously noted, COVID vaccines constitute a significant incremental global spend. All this means payers are seeking savings from medicines budgets. Managing spend on launch products by controlling price or access is an obvious step – and what we see in some Western European markets is a growing number of restrictions alongside a reimbursement decision, limiting patient opportunity more, a situation which will continue for the duration of the economic crisis.

Properties of resilient launches post-pandemic

Overall, then, there’s a continued launch performance problem – but is this true of all types of launch? There are non-COVID launches that have been resilient to the challenging Pandemic launch environment, and there are emerging common themes.

Orphan medicines and other specialty treatments such as cancer and HIV launches have been among the most consistently resilient over the course of the pandemic and across countries. These launches have in common addressing high unmet need in small, well-defined, and, crucially, mostly pre-identified patient populations. Therefore, the challenge of patient journeys disrupted or abandoned by the pandemic impacted less. Crucially also, healthcare systems remained highly motivated to fund and deliver pharmacotherapy to these patients even at the height of lockdowns. Among launches resilient for these reasons were Tepezza, an orphan thyroid eye disease medication in the US, Zolgensma, a gene therapy for Spinal Muscular atrophy in Germany, and more recently Evrysdi, an oral agent for the same condition.

Some cancer launches also exemplified another trait for post-pandemic launch resilience – drug delivery allowing patients to self-treat at home or minimising the amount of time they spend in healthcare facilities. Thus Phesgo, a sub-cutaneous version of an otherwise IV breast cancer treatment, and the oral cancer agent Calquence, both of which were resilient pandemic launches, demonstrated how minimising health facility visits, once a nice-to-have, is now a significant differentiator for post-pandemic launches.

The type of launch product clearly played an important role in pandemic launch resilience, but a company’s launch go-to-market model could also have a critical role. Here, preparedness and agility in the pivot to a digital engagement model was critical. In the US, where direct-to-consumer advertising meant the patient could be directly engaged even during lockdown, the two oral migraine treatments Nurtec and Ubrelvy did strongly during the first lockdowns, because patient awareness and demand were met by the rapid creation of a fully remote patient journey, from consultations with physicians through to prescription and medication delivery. Lockdowns are no longer; but the more hybrid model of physician and patient engagement is here to stay; the challenge for launching companies is how to optimise engagement impact and patient opportunity within them.

The post-pandemic launch pipeline remains strong in numbers and quality, diverse in launch type, and continues to address severe unmet needs. However, the launch environment they enter will continue to present severe challenges in patient opportunity, physician engagement and market access for the foreseeable future.

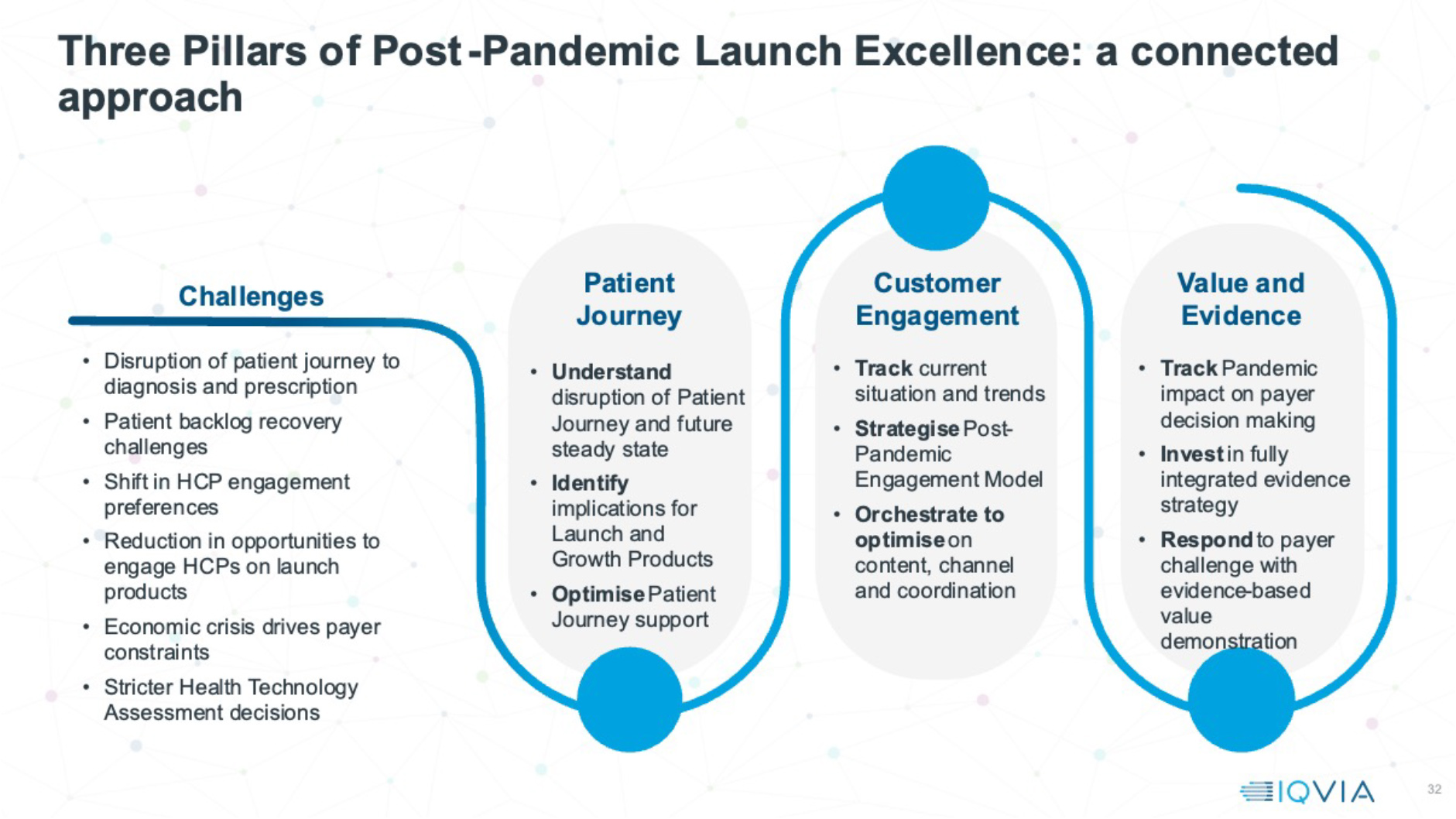

To thrive, companies need to plan their launches with different focus. They need to understand early in detail how patient journeys have changed and stall, identifying blocks on the road to diagnosis and treatment, and investing to address them. They must also optimise every single interactive engagement opportunity with doctors, real world or remote, and in some cases grow interactive engagement back to pre-pandemic levels. A fully integrated evidence strategy, driving a strong publication stream, is a door opener for engaging with doctors, and vital to differentiate in an access environment increasingly inclined to restrict access for new launches. These three pillars of post-pandemic launch excellence will be the foundation for post-pandemic launches to recover their potential.

To find out more about the issues discussed in this article, visit www.iqvia.com and search for “Launch Excellence”.

About the author

Sarah Rickwood, VP, EMEA Thought Leadership and Marketing, IQVIA. Sarah Rickwood has 30 years’ experience as a consultant to the pharmaceutical industry. She has an extremely wide experience of international pharmaceutical industry issues, consulting to the world’s leading pharmaceutical companies on global issues. She has been vice resident, European Marketing and Thought Leadership in IQVIA for 12 years. Sarah presents to hundreds of pharmaceutical industry clients every year on a range of global pharmaceutical industry issues, publishing white papers on many topics, including:

- uptake and impact of innovative medicines, and challenges for Launch Excellence

- the impact of the pandemic on medicines markets and Rx launch

- Orphan drugs launch challenges

- Cell and Gene therapies commercialization challenges and opportunity

Sarah holds a degree in biochemistry from Oxford University.

Kirstie works in IQVIA's EMEA Thought Leadership team, and has experience preparing white papers on priority healthcare topics such as the impact of biosimilars in Europe, the availability of medicines and product shortages. Kirstie has over 5 years’ experience in healthcare and life sciences, previously working to provide industry expertise and analytics which support industry associations to influence health policy, and providing clinical and commercial competitive insights for pharmaceutical companies. She holds a degree in Neuroscience from the University of Nottingham.

Kirstie works in IQVIA's EMEA Thought Leadership team, and has experience preparing white papers on priority healthcare topics such as the impact of biosimilars in Europe, the availability of medicines and product shortages. Kirstie has over 5 years’ experience in healthcare and life sciences, previously working to provide industry expertise and analytics which support industry associations to influence health policy, and providing clinical and commercial competitive insights for pharmaceutical companies. She holds a degree in Neuroscience from the University of Nottingham.